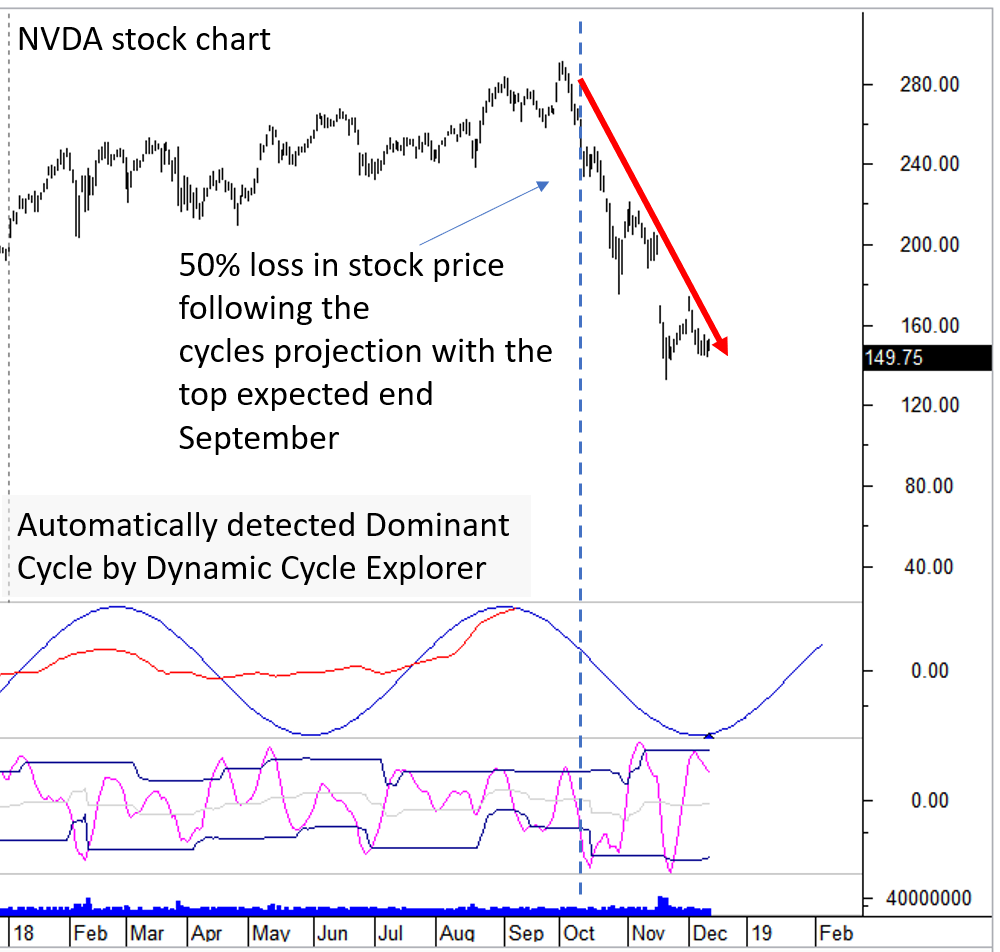

Rise and Fall of a Crypto Star: How Cycles Predicted the Crash of Nvidia

Sentiment cycles can even play a more important role in market analysis if both more traditional assets (e.g. stocks) and novel assets (e.g. crypto currencies) have significant correlations. The ability to find these types of situations, referred to as ‘cycles within cycles’, can lead to highly profitable trading set-ups.

This type of setup has been easy to see and follow in 2018. The emotional behavior of crypto currency values was obvious with a lot of publicity. The rise of the new crypto-assets drove demand for the underlying technologies. Nvidia’s GPUs were in high demand in crypto-currency mining and Nvidia was described as the “hottest stock” and top performer in the entire S&P 500 due to its high correlation to crypto mining.

In this report, we emphasize the importance of identifying cycles in emotional markets to identify turning points in correlated traditional financial assets. In this case we analyze the driving cycles of Nvidia and correlate them with the crypto-cycles.